Team Training: True Cost of Payroll

Overview

The True Cost of Payroll training activity is a great way to teach your employees how to read their pay stub and understand how much cash the company needs to make payroll.

Don’t assume all of your employees understand how to read their pay stub. You’ll be surprised by how many do not know why they have so many payroll deductions.

Benefits of Training Activity

- Employees will have a better understanding of their paycheck, income taxes and payroll deductions.

- Increase awareness of the company’s total payroll costs and how much cash is required.

- Employees appreciate the payroll clerk and payroll process

- Lay the foundation for sharing more information about numbers and processes in the future.

- Bridge the gap between the employee and business owner’s perspective of how much payroll really cost the company.

- Recruit great employees when you list personal finance education as an employee benefit.

Steps to Complete the Training Activity

- Teach your employees how to read their pay stub

Create a sample that look like your company’s pay stub. Teach how each line is calculated and which deductions are required versus voluntary.

- Teach your team where their money goes (deductions)

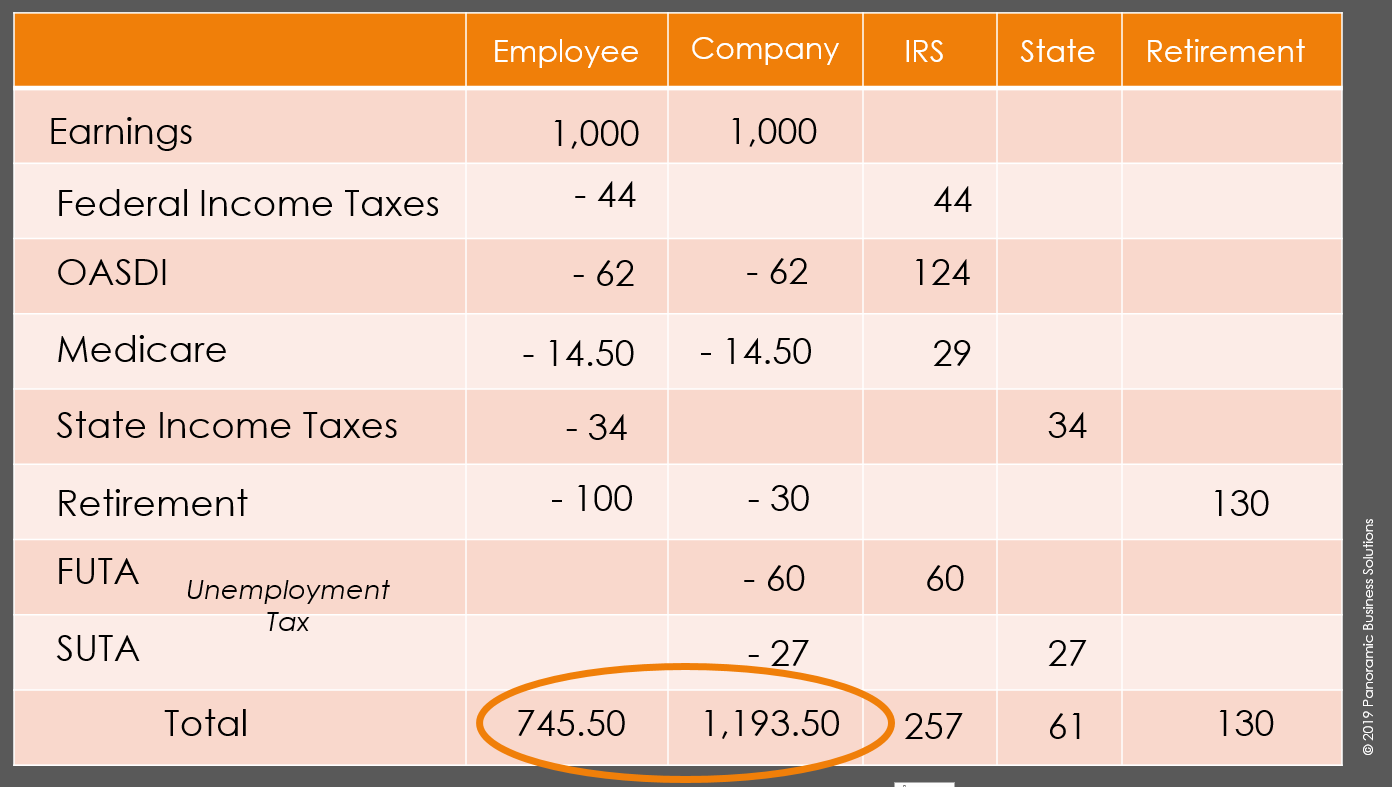

Here’s a slide to spark ideas for you…keep in mind, this is a basic illustration.

Presentation tip: I created this illustration in PowerPoint allowing me to reveal one number at a time as I explained it. Otherwise, the grid is way too busy and confusing.

Check out the video above to see my demonstration of this slide.

- Ask the question “How much cash does the company need to pay John?”

This illustration is very surprising to most employees.

Imagine the story that runs through the employee’s mind versus the business owner’s mind.

During the interview process, the business owner agreed to pay the employee $1,000 per week.

Employee’s perspective: After a long week of hard work, the employee reviews their pay stub online, sees a deposit of only $745.50 and questions where all of their money went.

Business owner’s perspective: The business owner reviews the payroll report, sees a cash commitment of $1,193.50 and wonders why they need almost 20% more cash than they originally agreed to pay.

There is naturally a $448 difference between the employee’s perspective of $745.50 and the business owner’s perspective of $1,193.50. This is one of the many ways employees and business owners are not on the same page. This simple training activity bridges the communication gap and helps employees see the big picture.

- Identify the other expenses that are affected by payroll

Don’t stop with the pay stub. Keep the training going. Teach your team how payroll expense is related to other business expenses.

It’s common for workers compensation and general liability premiums to increase when payroll expense increases.

- Payroll Clerk for the Day activity

Create a simple payroll example and ask your employees to calculate the net amount the employee would be paid. Share all of the resources they’ll need to calculate everything including the federal and state income tax tables.

It’s unlikely your employees will complete this exercise. After a few minutes, you’ll start to hear grumbling from the back of the room. An employee may even yell out “thank you Cathy (insert your payroll clerk’s name)”.

Stop the torture exercise and walk through the example as a group.

Did you know Disney® cross-trains employees in other roles? Even if you work in the office, you can learn how to be Mickey Mouse® for the day. This is a great way for employees to walk in each other’s shoes.

This training exercise is the closest you’ll get to helping your team walk in the shoes of your payroll clerk. The goal is to shine a light on a role that is often underappreciated. After an activity like this, your employees are more likely to have empathy for you and your payroll clerk when a mistake is made. Everyone will understand payroll requires more than a basic math formula…hourly rate x hours.

- Reflect with your team

Before you end the training session, ask your team questions like “what surprised you most? or “what did you learn?” You’ll hear things like “I had no idea the company pays payroll taxes for me too.”

Ideally, your team will have a new appreciation for your payroll clerk. Ask everyone to give a round of applause to your payroll clerk.

- Reinforce the training

At the next meeting, follow up with your team to see if they have any questions about their pay stub or the previous training.

Consider surprising your employees with a pop quiz and give the employee with the highest score a small prize.

Here is an example of a fill-in-the blank worksheet to inspire you when you create your pop quiz:

- Repeat

It’s unlikely you’ll need to repeat this activity with your team every year, but it’s important to teach the activity to new employees. Consider adding this training to your new employee orientation.

You may also enjoy...

Join the Community!

Learn the business skills you need

to grow a healthy, thriving business.

Wherever you are in your growth journey,

we’re here to help you get there

and avoid the potholes along the way.

Unsubscribe anytime.